The mobile banking sector may have room for more players as less than two fifths of industry professionals believe it is becoming overcrowded.

The market has experienced immense growth in recent years, with 69% of British millennials having used a mobile banking app, while mobile banking transactions are forecast to more than double by 2022.

However, with the mobile banking sector featuring many new providers, is there a worry that the market is becoming too saturated?

According to RFi Group's latest Global Digital Banking Report for H2 2017, the global appetite for digital-only banking providers fell from 74% in H1 2017 to 63% in H2.

Last month, Specialist Banking revealed an industry expert's prediction that the digital-only banking sector could see some form of consolidation in the future.

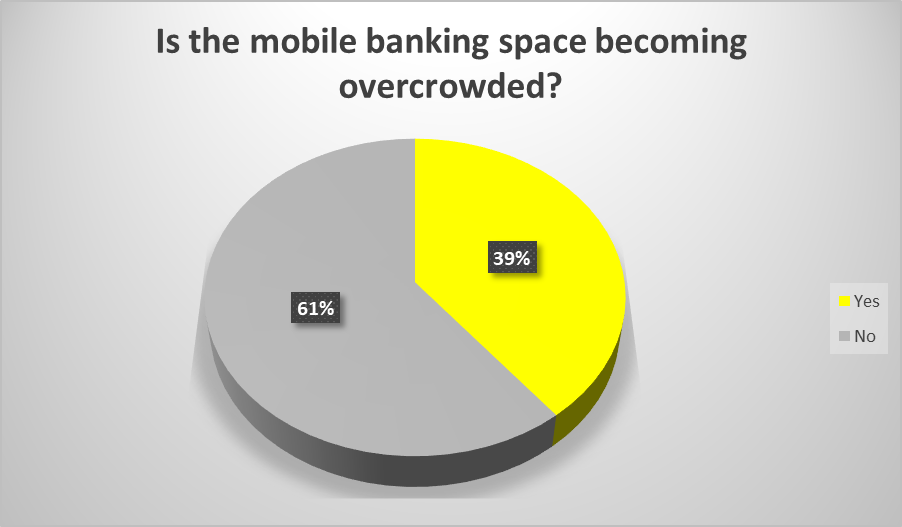

Following this, Specialist Banking recently conducted a poll asking its readers whether the mobile banking space was becoming overcrowded, where 61% said no, while just 39% said yes.

Commenting on the outcome, John Gunn, executive chairman at SynerGIS Capital said: “These results show a real appetite for diversity from consumers.

“In a sustained period of low interest rates, consumers are welcoming the competition and relishing the control they have in making financial decisions that are benefiting them the most.

“It's a fast moving time for the fintech industry and, with the digital wave continuing to strengthen, banks are working hard to keep up.

“That teamed with the launch of Open Banking comes improved offerings and, at SynerGIS, we have seen considerable interest in our forthcoming bond launch.'

Tristan Thomas, head of marketing and community at Monzo, added: “In the last few years there's definitely been an increase in the number of digital banking providers in the market - including us.

“Recent changes to banking laws and the introduction of Open Banking have provided an ideal landscape for fintech banks, such as ourselves, to provide a real alternative to traditional banks.

“Naturally, more providers mean more competition.

“This is only a good thing for the industry because it motivates us to build the best product for customers and focus on our aim: building a bank that really works for everyone.'

Digital banks from continental Europe have also seen the UK's potential for expansion.

Last week, German provider N26 raised $160m in a Series C funding round to support its UK and US expansion.

Room for more mobile banking players?

Nikolay Storonsky, CEO and founder of Revolut believed that increased competition should be treated as an opportunity.

“As long as there is innovation, there is room for more players in the space,' he added.

“If mobile banking services continue to create new products or utilise new technology, we'll be able to offer a more competitive marketplace and provide better customer experiences for mobile banking users.'

Nikolay explained that competition in the mobile banking space also prevented complacency.

“If companies are constantly trying to create better financial products for their customers, we'll improve the financial services industry as a whole."

Just the beginning

Norris Koppel, CEO and founder of Monese, said the mobile banking space was definitely not becoming overcrowded.

“As people increasingly prefer mobile devices for their everyday banking needs, it is only natural to expect that all traditional retail banks will focus on mobile banking sooner or later to avoid becoming irrelevant.

“When we look at the new digital challenger banks, there are currently only a handful of these in Europe and this is just [the] beginning.

“Each one of them will need to find their own unique angle in order to be relevant for their audiences, but there is room for plenty more.

“Customers will hugely benefit from these market developments through better services and those banks who put customers first will be able to gain most."

-

Temenos partners with ClearBank for cloud payments

Banking software company Temenos has formed a strategic relationship with ClearBank to provide banks with a faster route to market for real-time cloud payments...

-

Unity Trust Bank registers 34% rise in profits

Unity Trust Bank increased profits by 34% in 2019...

-

Believe the hype – why explainable AI is a trend that’s here to stay

Technology has become a ubiquitous part of our day-to-day lives...

-

Piloting tech updates: ‘The bigger the bank, the harder it is to get anything done’

In the latest Medianett filmed roundtable session, we discussed how important technology is in the banking space, and what impact the industry expects it to have on its businesses in the future...

-

What banks need to know about cloud security

One of the most common perceived concerns when adopting the cloud is the issue of security...

-

OakNorth sees 95% increase in pre-tax profits

OakNorth Bank has announced a 95% rise in pre-tax profits in 2019 to £65.9m, up from the £33.9m recorded in 2018...

-

Redwood Bank signs up to Women in Finance Charter

Redwood Bank has announced that it has signed up to the Women in Finance (WIF) Charter...

-

Masthaven launches digital Women in Leadership programme

Masthaven Bank has launched a new Women in Leadership digital development programme for female senior leaders...

-

Protecting against supply chain disruption and the domino effect

Disappointingly, many UK SME business owners don’t understand their supply chains...

-

Confused about which Isa to choose? Hopefully this mini-guide will help…

We are now firmly in Isa season, so you’re likely to read multiple articles about the most competitive Isa products in the market and how best to make the most of your Isa allowance before the end of the tax year...

-

Garden shed entrepreneurs contribute £16.6bn to the UK economy

Entrepreneurs who run their businesses from garden sheds contribute £16.6bn annually to the UK economy, according to a recent study...