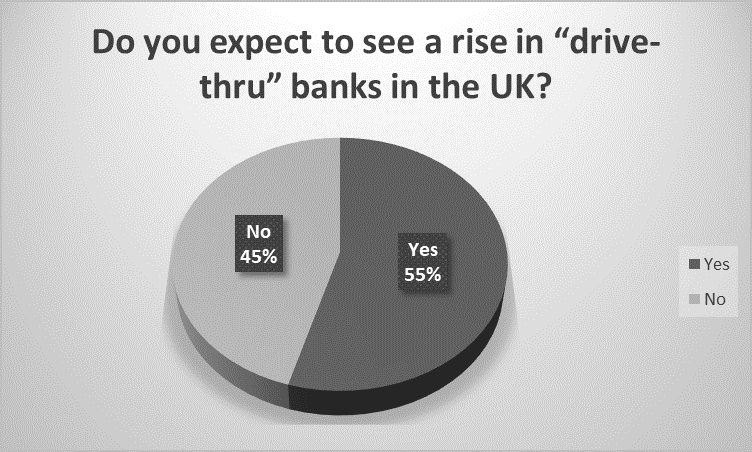

Just over half of finance professionals have said they expect to see an increase in 'drive-thru' banks, according to a survey conducted by Specialist Banking.

In the poll – which posed the question: 'Do you expect to see a rise in “drive-thru” banks in the UK?' – 55% responded 'yes'.

Metro Bank has been leading the way with this trend having launched its first drive-thru at its Slough store in May 2013.

This store provides two drive-thru lanes with a dedicated cashier, allowing customers to pay in cash and cheques and withdraw funds from their accounts.

Metro Bank went on to open London's first drive-thru bank in October 2015 in Southall, with a third drive-thru facility opening in October this year in Luton.

Iain Kirkpatrick, managing director retail banking at Metro Bank, said: “Customers want choice when it comes to how, when and where they do their banking, whether that's in store, online, by phone, through an app or from the seat of their car.

“Our drive-thrus have proven to be extremely popular among our broad customer base.

“Whether you're a parent with a car full of kids, a business owner cashing in your takings or just want to avoid the rain, our drive-thrus make banking even more convenient.”

However, Graham Lloyd, industry principal of financial services at banking software provider Pegasystems, didn't see too many benefits for customers with regards to drive-thru banks.

“It's hard to see how drive-thru banking will penetrate far in the UK, for both banking and cultural/logistical reasons,” said Graham.

“We have increasingly fewer reasons for visiting a branch, with the banks themselves pushing us towards alternative, automated channels (despite a staunch rearguard action by the likes of Metro, even the most dedicated branch service offerings don't draw us in droves).

“Many people split their banking needs among several providers, so the 'value' of any visits we do make is diminished.

“And generally, banks are simply no longer the destinations they once were, being more componentry in other value chains.

“As [the writer] Bill Bryson observed, compared to the US, we tend not to drive as frequently to any venue except shopping malls; we are willing, if occasionally reluctant, walkers and actually quite like the way of life in our villages and high streets.

“Drive-thru simply doesn't carry the same convenience here and even if it did, our sense of privacy poses big questions around what exactly we would be willing to discuss from the car window.

“The only potential positive is the splash of novelty were a bank to promote drive-thru.

“But this is hardly the stuff of substance or sustainability.”

-

Temenos partners with ClearBank for cloud payments

Banking software company Temenos has formed a strategic relationship with ClearBank to provide banks with a faster route to market for real-time cloud payments...

-

Unity Trust Bank registers 34% rise in profits

Unity Trust Bank increased profits by 34% in 2019...

-

Believe the hype – why explainable AI is a trend that’s here to stay

Technology has become a ubiquitous part of our day-to-day lives...

-

Piloting tech updates: ‘The bigger the bank, the harder it is to get anything done’

In the latest Medianett filmed roundtable session, we discussed how important technology is in the banking space, and what impact the industry expects it to have on its businesses in the future...

-

What banks need to know about cloud security

One of the most common perceived concerns when adopting the cloud is the issue of security...

-

OakNorth sees 95% increase in pre-tax profits

OakNorth Bank has announced a 95% rise in pre-tax profits in 2019 to £65.9m, up from the £33.9m recorded in 2018...

-

Redwood Bank signs up to Women in Finance Charter

Redwood Bank has announced that it has signed up to the Women in Finance (WIF) Charter...

-

Masthaven launches digital Women in Leadership programme

Masthaven Bank has launched a new Women in Leadership digital development programme for female senior leaders...

-

Protecting against supply chain disruption and the domino effect

Disappointingly, many UK SME business owners don’t understand their supply chains...

-

Confused about which Isa to choose? Hopefully this mini-guide will help…

We are now firmly in Isa season, so you’re likely to read multiple articles about the most competitive Isa products in the market and how best to make the most of your Isa allowance before the end of the tax year...

-

Garden shed entrepreneurs contribute £16.6bn to the UK economy

Entrepreneurs who run their businesses from garden sheds contribute £16.6bn annually to the UK economy, according to a recent study...