Bootle in Merseyside has emerged as the best place to offer rental property, according to research by Gatehouse Bank.

The specialist bank found that the annual yield in the town was 5.6%, compared with the national average of 4.6%.

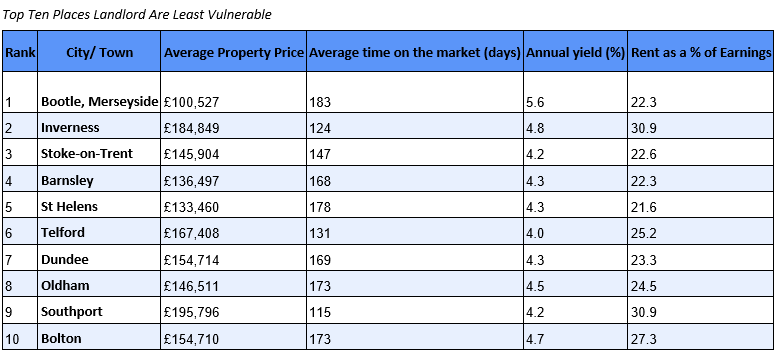

The research revealed the top 10 most and least vulnerable landlord locations in the country.

Landlords in Bootle were the least vulnerable in the country, with high yields and properties staying on the market for an average of 183 days.

However, landlords in Winchester were the most vulnerable, with a rental yield of 3.1% and an average of 248 days on the market.

The full results:

Charles Haresnape, CEO at Gatehouse Bank, said its research showed that famous northern hospitality was not a myth.

“It’s a great place not only to be a landlord, but also to live, with cities in the North and the Midlands performing much better across all indicators.

“Rental properties are let far quicker than in the South, which is no surprise when major cities like Liverpool and Manchester are within commuting distance of smaller towns like Bootle.

“What’s really striking is that in the areas that performed best, rental rates were far more affordable and this correlation underscores the symbiotic relationship between renters and landlords in areas where [the latter’s] investments could be deemed safest.”

-

Temenos partners with ClearBank for cloud payments

Banking software company Temenos has formed a strategic relationship with ClearBank to provide banks with a faster route to market for real-time cloud payments...

-

Unity Trust Bank registers 34% rise in profits

Unity Trust Bank increased profits by 34% in 2019...

-

Believe the hype – why explainable AI is a trend that’s here to stay

Technology has become a ubiquitous part of our day-to-day lives...

-

Piloting tech updates: ‘The bigger the bank, the harder it is to get anything done’

In the latest Medianett filmed roundtable session, we discussed how important technology is in the banking space, and what impact the industry expects it to have on its businesses in the future...

-

What banks need to know about cloud security

One of the most common perceived concerns when adopting the cloud is the issue of security...

-

OakNorth sees 95% increase in pre-tax profits

OakNorth Bank has announced a 95% rise in pre-tax profits in 2019 to £65.9m, up from the £33.9m recorded in 2018...

-

Redwood Bank signs up to Women in Finance Charter

Redwood Bank has announced that it has signed up to the Women in Finance (WIF) Charter...

-

Masthaven launches digital Women in Leadership programme

Masthaven Bank has launched a new Women in Leadership digital development programme for female senior leaders...

-

Protecting against supply chain disruption and the domino effect

Disappointingly, many UK SME business owners don’t understand their supply chains...

-

Confused about which Isa to choose? Hopefully this mini-guide will help…

We are now firmly in Isa season, so you’re likely to read multiple articles about the most competitive Isa products in the market and how best to make the most of your Isa allowance before the end of the tax year...

-

Garden shed entrepreneurs contribute £16.6bn to the UK economy

Entrepreneurs who run their businesses from garden sheds contribute £16.6bn annually to the UK economy, according to a recent study...