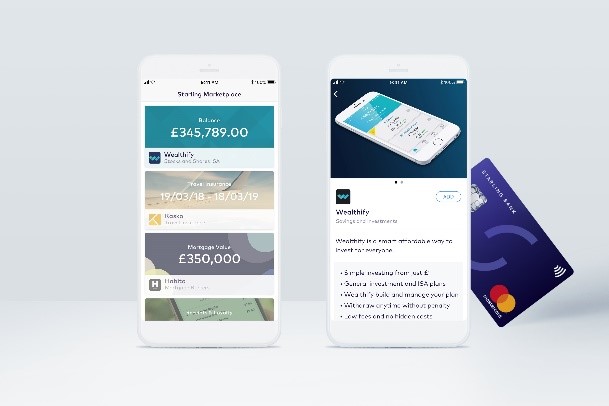

Starling Bank has welcomed online investment service Wealthify to its in-app marketplace .

Wealthify – which is backed by insurance company Aviva – offers low-cost Isa and general investment plans, containing investments such as shares, bonds, property and commodities.

Starling's in-app marketplace provides its customers with direct access to financial services and products securely on their phone.

As a result of this new partnership, Wealthify will be available to all Starling customers, while Wealthify customers can now get an overview of their investments via their Starling account.

“At Starling, we're on a mission to deliver our customers the best banking experience in the world,' said Megan Caywood, chief platform officer at Starling Bank (pictured above).

“By partnering with innovative and disruptive companies, such as Wealthify, we're aiming to bring the best financial services and products directly into our customer's pockets through our in-app marketplace.

“We are excited to welcome Wealthify and look forward to announcing more partnerships soon.'

Michelle Pearce, chief investment officer at Wealthify, said the open architecture marketplace that Starling had created was a vision of the future of banking.

“Their simple and transparent approach is perfectly aligned with our mission to democratise investing, by breaking down the common barriers holding people back, such as lack of confidence, the belief that you need to be an expert to invest, or thinking you need lots of money.

“We're extremely excited to partner with Starling Bank and pleased to be able to offer their customers easy access to Wealthify investment services through the in-app marketplace.'

-

Temenos partners with ClearBank for cloud payments

Banking software company Temenos has formed a strategic relationship with ClearBank to provide banks with a faster route to market for real-time cloud payments...

-

Unity Trust Bank registers 34% rise in profits

Unity Trust Bank increased profits by 34% in 2019...

-

Believe the hype – why explainable AI is a trend that’s here to stay

Technology has become a ubiquitous part of our day-to-day lives...

-

Piloting tech updates: ‘The bigger the bank, the harder it is to get anything done’

In the latest Medianett filmed roundtable session, we discussed how important technology is in the banking space, and what impact the industry expects it to have on its businesses in the future...

-

What banks need to know about cloud security

One of the most common perceived concerns when adopting the cloud is the issue of security...

-

OakNorth sees 95% increase in pre-tax profits

OakNorth Bank has announced a 95% rise in pre-tax profits in 2019 to £65.9m, up from the £33.9m recorded in 2018...

-

Redwood Bank signs up to Women in Finance Charter

Redwood Bank has announced that it has signed up to the Women in Finance (WIF) Charter...

-

Masthaven launches digital Women in Leadership programme

Masthaven Bank has launched a new Women in Leadership digital development programme for female senior leaders...

-

Protecting against supply chain disruption and the domino effect

Disappointingly, many UK SME business owners don’t understand their supply chains...

-

Confused about which Isa to choose? Hopefully this mini-guide will help…

We are now firmly in Isa season, so you’re likely to read multiple articles about the most competitive Isa products in the market and how best to make the most of your Isa allowance before the end of the tax year...

-

Garden shed entrepreneurs contribute £16.6bn to the UK economy

Entrepreneurs who run their businesses from garden sheds contribute £16.6bn annually to the UK economy, according to a recent study...