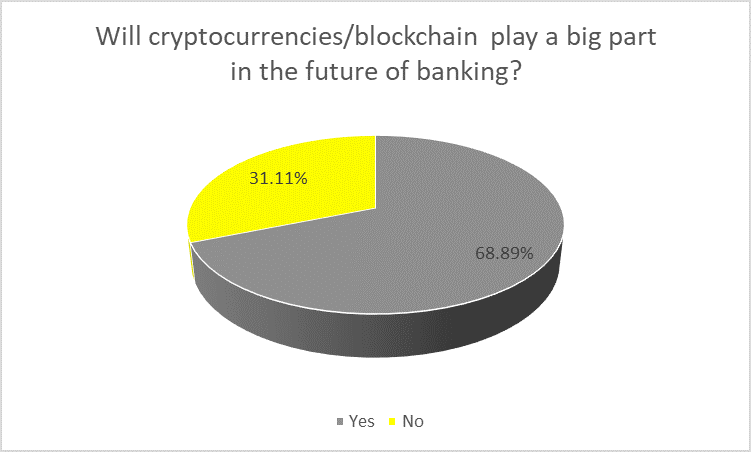

A recent poll conducted by Specialist Banking found that 6889% of financial intermediaries believe that cryptocurrencies/blockchain will play a big part in the future of banking.

Some banks are considering incorporating blockchain into their businesses or offer services that deal with cryptocurrencies.

Earlier this year, mobile bank Revolut announced it was soon to release phase one of its cryptocurrency offering to its customers.

'Financial Services: Building Blockchain One Block at a Time' – a study by global technology consulting and services firm Cognizant – found that three-quarters of financial services executives predicted that their revenues would grow by more than 5% following the adoption of blockchain.

However, only 48% of respondents reported that they had a defined blockchain strategy.

“These results [the Specialist Banking poll] show the potential that many within the banking industry already see in blockchain technology and cryptocurrencies,' said Rahim Kaba, director of product marketing at VASCO, a software firm which works with companies such as Wells Fargo, US Bank, JP Morgan Chase and RBC Royal Bank.

“As the pressure to digitise processes, strengthen compliance and audit practices and transact securely across channels increases, blockchain is emerging as a viable digital platform that can adequately address both consumer and business concerns.

“Blockchain gives banks and other financial institutions choice with respect to the technology platform they choose while digitising business transactions.

“In the lending market, for example, leveraging blockchain to record transactions tied to loans provides a new way of transacting with multiple parties in an open, efficient and cost-effective manner.

“Direct participants and 'observers' such as auditors and regulators can more easily track transactions and verify their authenticity.

“Blockchain's decentralised approach ultimately changes the dynamics of today's financial system – shifting the power from institutions to users.'

Jon Matonis, VP corporate strategy at blockchain research and development specialist nChain, said: “Prevailing wisdom states that there is a potential $20bn in costs savings to be realised by banks via improved blockchain reconciliation processes.'

Research has shown that blockchain technology could reduce infrastructure costs for eight of the world's 10 largest investment banks by an average of 30%.

“Regarding the readership poll on the topic of cryptocurrencies and blockchain playing a larger role in banking, I would caution that it may not be in the way banks expect because public blockchain cryptocurrencies remove barriers to entry and bring new market entrants into the traditional functional roles of banking,' added Jon.

Graham Lloyd, director and industry principal of financial services at Pegasystems, believed it was not a question of whether or not cryptocurrencies/blockchain would play a big part in the future of banking but, instead, how long it would take.

“It's difficult for people to understand how cryptocurrencies are controlled, but even harder to get comfortable about their value fluctuations.'

A recent study by HSBC revealed that 80% of respondents did not understand blockchain.

“As people become more comfortable and develop a greater understanding of blockchain, their perceptions will change,' added Graham.

“While some suggest it will be a force for good, others suggest that the changes it would impose on the way these organisations operate will leave a trail of ruin in their wake.

“Either way, one thing seems certain: the potentially huge blockchain iceberg lying on the financial services industry horizon requires careful navigation to avoid a massive collision.'

-

Temenos partners with ClearBank for cloud payments

Banking software company Temenos has formed a strategic relationship with ClearBank to provide banks with a faster route to market for real-time cloud payments...

-

Unity Trust Bank registers 34% rise in profits

Unity Trust Bank increased profits by 34% in 2019...

-

Believe the hype – why explainable AI is a trend that’s here to stay

Technology has become a ubiquitous part of our day-to-day lives...

-

Piloting tech updates: ‘The bigger the bank, the harder it is to get anything done’

In the latest Medianett filmed roundtable session, we discussed how important technology is in the banking space, and what impact the industry expects it to have on its businesses in the future...

-

What banks need to know about cloud security

One of the most common perceived concerns when adopting the cloud is the issue of security...

-

OakNorth sees 95% increase in pre-tax profits

OakNorth Bank has announced a 95% rise in pre-tax profits in 2019 to £65.9m, up from the £33.9m recorded in 2018...

-

Redwood Bank signs up to Women in Finance Charter

Redwood Bank has announced that it has signed up to the Women in Finance (WIF) Charter...

-

Masthaven launches digital Women in Leadership programme

Masthaven Bank has launched a new Women in Leadership digital development programme for female senior leaders...

-

Protecting against supply chain disruption and the domino effect

Disappointingly, many UK SME business owners don’t understand their supply chains...

-

Confused about which Isa to choose? Hopefully this mini-guide will help…

We are now firmly in Isa season, so you’re likely to read multiple articles about the most competitive Isa products in the market and how best to make the most of your Isa allowance before the end of the tax year...

-

Garden shed entrepreneurs contribute £16.6bn to the UK economy

Entrepreneurs who run their businesses from garden sheds contribute £16.6bn annually to the UK economy, according to a recent study...