Older travellers are increasingly leading the way when it comes to gap years, according to new research from Charter Savings Bank.

The specialist bank has found that 40% of workers were planning to have a gap year when they are 60-plus and will fund the trip with savings built up through a lifetime of work.

Meanwhile, just 18% were planning gap years by the time they were 30.

The research found that 49% of over-45s had never taken a gap year or an extended break from work, but intended to take their chance to travel once they were in their 60s or retired.

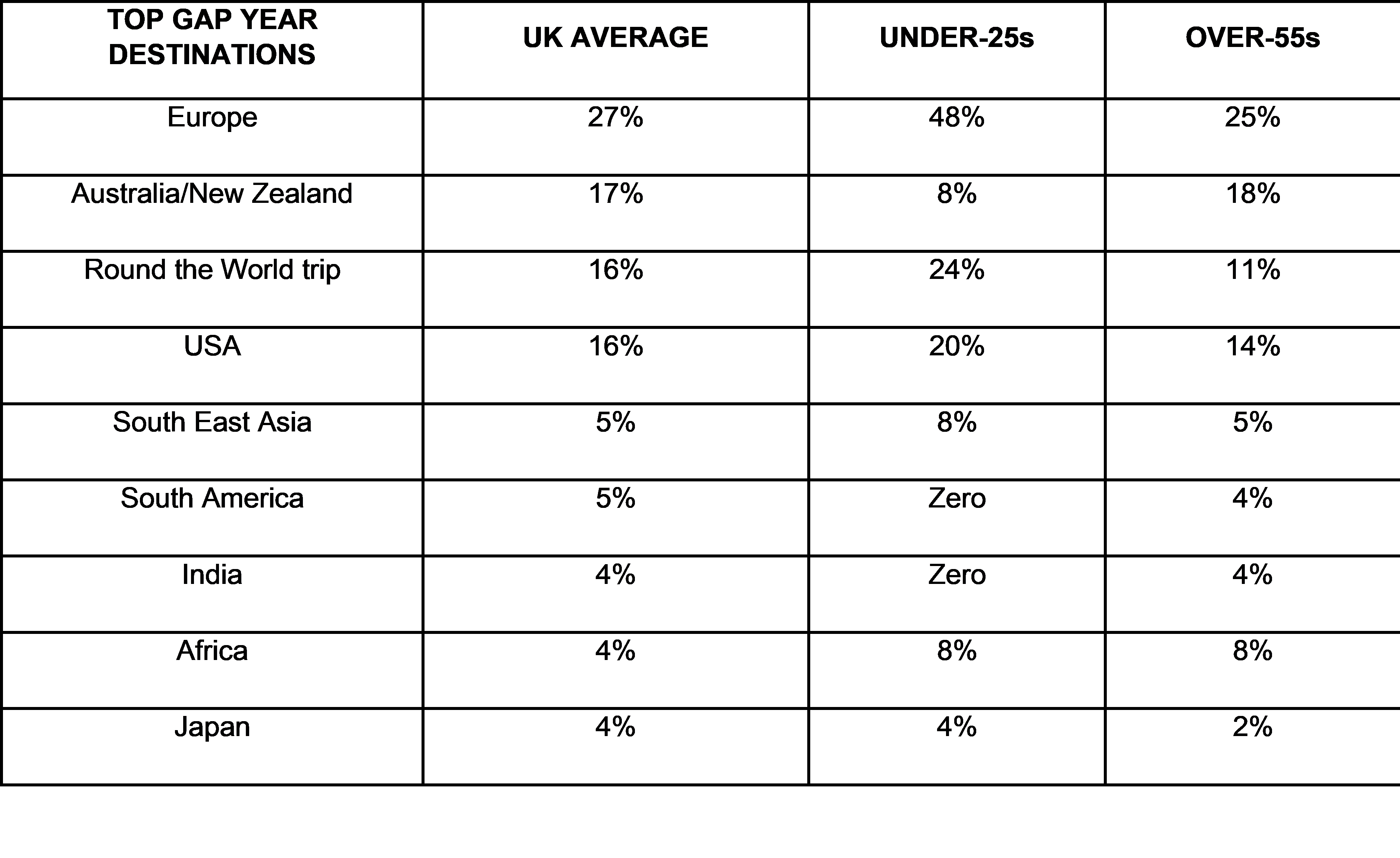

Source: Charter Savings Bank, September 2017

Charter Savings Bank found that 63% would take money from their savings accounts to fund the trip, with just 7% using credit cards.

“Many of us think about gap years being the preserve of backpacking students, but increasingly we're seeing that older customers are catching the travelling bug,” said Paul Whitlock, director of savings at Charter Savings Bank.

“It's worth remembering that once-in-a-lifetime opportunities can happen at any time of life, and while globe-trotting in your 60s might seem like a long time to wait, it does have the advantage of travelling in a little more luxury and not having to run up debts to fund it.

“It definitely highlights that a savings habit does pay off, even if the amount you're able to put aside today seems too small to make a difference.”

-

Temenos partners with ClearBank for cloud payments

Banking software company Temenos has formed a strategic relationship with ClearBank to provide banks with a faster route to market for real-time cloud payments...

-

Unity Trust Bank registers 34% rise in profits

Unity Trust Bank increased profits by 34% in 2019...

-

Believe the hype – why explainable AI is a trend that’s here to stay

Technology has become a ubiquitous part of our day-to-day lives...

-

Piloting tech updates: ‘The bigger the bank, the harder it is to get anything done’

In the latest Medianett filmed roundtable session, we discussed how important technology is in the banking space, and what impact the industry expects it to have on its businesses in the future...

-

What banks need to know about cloud security

One of the most common perceived concerns when adopting the cloud is the issue of security...

-

OakNorth sees 95% increase in pre-tax profits

OakNorth Bank has announced a 95% rise in pre-tax profits in 2019 to £65.9m, up from the £33.9m recorded in 2018...

-

Redwood Bank signs up to Women in Finance Charter

Redwood Bank has announced that it has signed up to the Women in Finance (WIF) Charter...

-

Masthaven launches digital Women in Leadership programme

Masthaven Bank has launched a new Women in Leadership digital development programme for female senior leaders...

-

Protecting against supply chain disruption and the domino effect

Disappointingly, many UK SME business owners don’t understand their supply chains...

-

Confused about which Isa to choose? Hopefully this mini-guide will help…

We are now firmly in Isa season, so you’re likely to read multiple articles about the most competitive Isa products in the market and how best to make the most of your Isa allowance before the end of the tax year...

-

Garden shed entrepreneurs contribute £16.6bn to the UK economy

Entrepreneurs who run their businesses from garden sheds contribute £16.6bn annually to the UK economy, according to a recent study...