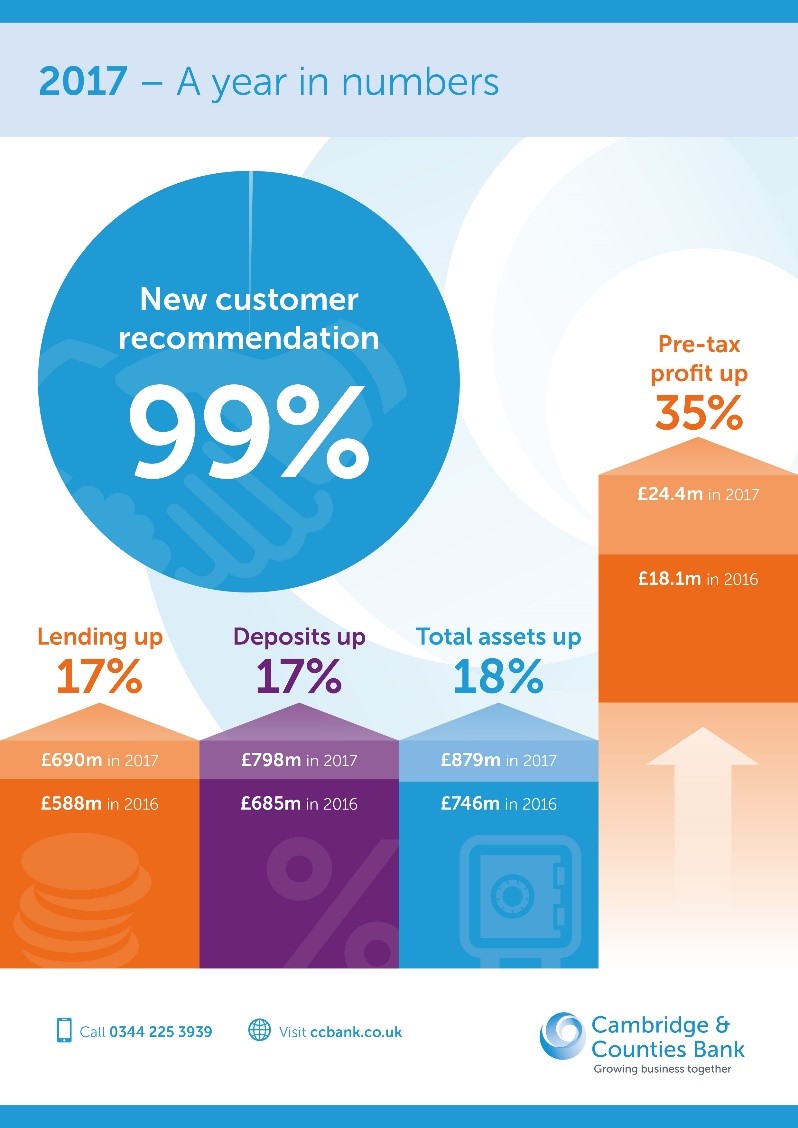

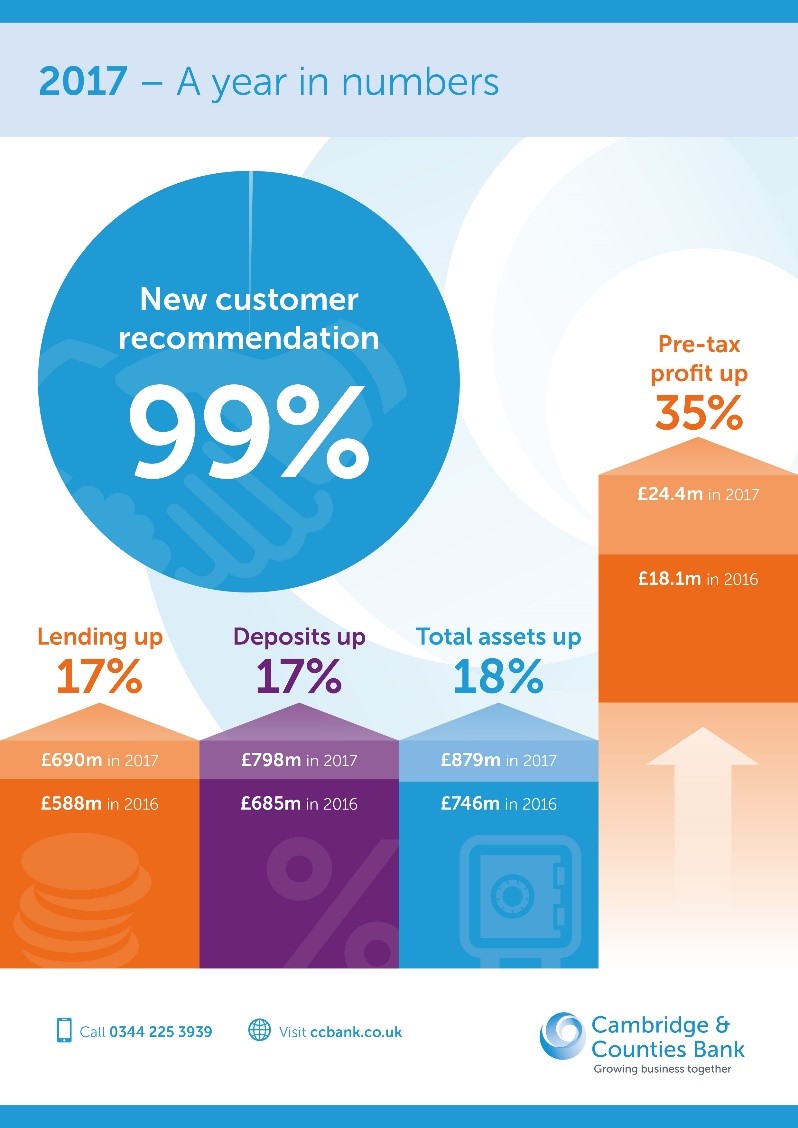

Cambridge & Counties has announced a profit before tax of £244m for 2017, a 35% rise on the previous year.

Between January and December 2017, the bank – which specialises in secured lending and desposit products for SME – saw its balance sheet grow from £746m to £879m.

The specialist bank's loan balances also grew from £588m to £690m, with total deposits rising from £685m to £798m in the same period.

“We have created a unique proposition in the niche markets we operate in that is based around elevated levels of personalised service combined with the speed, efficiency and know-how that is needed in today's modern world,” said Mike Kirsopp, chief executive at Cambridge & Counties Bank (pictured above).

“We enjoyed another year of impressive growth in 2017, and although there are clearly risks in the marketplace, we remain optimistic for the future.

“In terms of Brexit, the full effect of this will not be known for around four years, but in the meantime, we haven't seen any significant impact on our markets or business.”

Cambridge & Counties also revealed that it had maintained new customer recommendation levels at 99%, despite the rise in new business.

“The fact we have maintained such high customer satisfaction levels during our strong growth is testament to the strength of our team and systems,” said Simon Moore, chairman at Cambridge & Counties.

“However, we are not resting on our laurels.

“We will make further investment in our customer-experience technology and will continue to look at ways we can enhance our existing product range and potentially launch into new markets.”

-

Temenos partners with ClearBank for cloud payments

Banking software company Temenos has formed a strategic relationship with ClearBank to provide banks with a faster route to market for real-time cloud payments...

-

Unity Trust Bank registers 34% rise in profits

Unity Trust Bank increased profits by 34% in 2019...

-

Believe the hype – why explainable AI is a trend that’s here to stay

Technology has become a ubiquitous part of our day-to-day lives...

-

Piloting tech updates: ‘The bigger the bank, the harder it is to get anything done’

In the latest Medianett filmed roundtable session, we discussed how important technology is in the banking space, and what impact the industry expects it to have on its businesses in the future...

-

What banks need to know about cloud security

One of the most common perceived concerns when adopting the cloud is the issue of security...

-

OakNorth sees 95% increase in pre-tax profits

OakNorth Bank has announced a 95% rise in pre-tax profits in 2019 to £65.9m, up from the £33.9m recorded in 2018...

-

Redwood Bank signs up to Women in Finance Charter

Redwood Bank has announced that it has signed up to the Women in Finance (WIF) Charter...

-

Masthaven launches digital Women in Leadership programme

Masthaven Bank has launched a new Women in Leadership digital development programme for female senior leaders...

-

Protecting against supply chain disruption and the domino effect

Disappointingly, many UK SME business owners don’t understand their supply chains...

-

Confused about which Isa to choose? Hopefully this mini-guide will help…

We are now firmly in Isa season, so you’re likely to read multiple articles about the most competitive Isa products in the market and how best to make the most of your Isa allowance before the end of the tax year...

-

Garden shed entrepreneurs contribute £16.6bn to the UK economy

Entrepreneurs who run their businesses from garden sheds contribute £16.6bn annually to the UK economy, according to a recent study...